Why Your Company Needs to Provide Health Insurance Plan For Your Employees

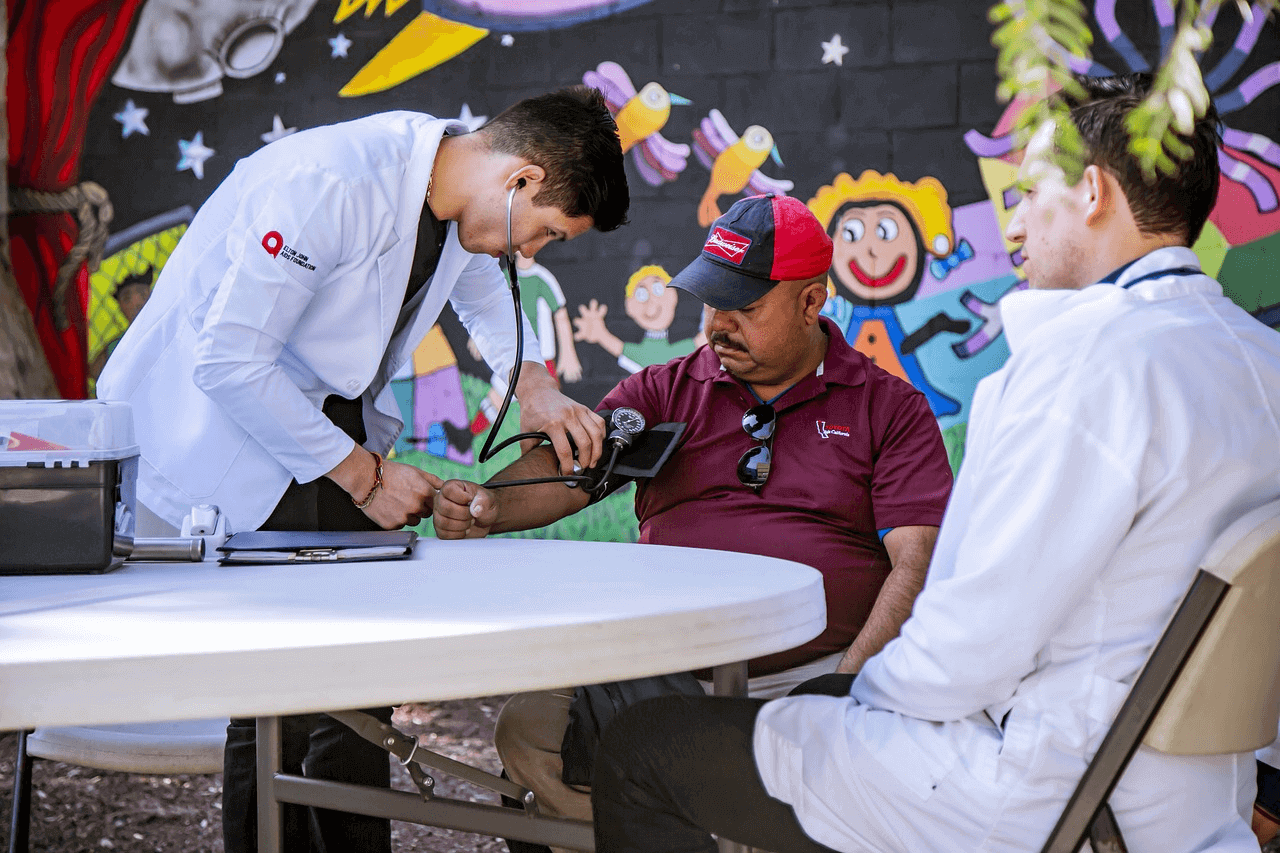

Taking care of your health is vital if you want to have a good quality of life. If you run your own company, you’re quite aware that your employees are your main strength.

That’s why you should encourage them to get health coverage. One of the biggest reasons why many companies have health insurance plans is that their employees can’t be as productive and successful if they are feeling unhealthy and unmotivated.

As their leader, it’s your responsibility to motivate them to take care of their wellbeing.

Insurance Seems Complicated

We tend to avoid things that are not easy for us to comprehend and bringing in a health insurance broker will help to solve these uncertainties. This person will explain with ease why your employees need Qantas health and demonstrate the entire process for them.

Key to Happiness

Having a successful team means your employees are happy in their personal and professional lives. The glue that holds these two worlds together is an employee’s wellbeing. Anything that affects their wellbeing will also affect their work performance. That’s why it’s in your best interest to motivate them to start thinking about their health plan.

Attracting Quality Talent

As mentioned above, having great health insurance is fantastic for both your current employees and your candidates. In today’s highly competitive world, it’s only natural that companies want to attract top-notch talent. That’s yet another reason why every company should offer benefit packages and promote them while recruiting.

Saving Money

Explaining to your employees they can save money with your company’s health insurance plan will probably motivate them the most. If you encourage your employees to choose your plan over an individual policy, they can save up to 30-45% on their premiums. This is even more efficient than increasing salaries as they will never get the same price for themselves as they would as a group.

Your Checklist

If your company still doesn’t have health coverage, it’s never too late to create one. Before crafting your plan and sitting down with your insurance consultant, you should ask yourself these questions:

- Do your employees want healthcare?

- How much can your company and your employees afford to pay?

- Do any of your employees qualify for a subsidy?

- What is vital to your employees regarding deductibles, coinsurance, etc.?

- What’s the maximum amount your employees will have to pay in worst-case scenarios if they have health insurance?

- How often will you and your employees have to see the doctor?